Pradhan Mantri Suraksha Bima Yojana-Accidental Insurance Policy

Pradhan Mantri Suraksha Bima Yojana is an accidental insurance scheme launched by Government of India by PM Mr. Narendra Modi. It was announced in 2015 budget by Finance Minister Mr. Arun Jeitly and it was launched by Prime Minister of India on 9th May 2015 in Kolkata. It is also known as PMSBY, short form of Pradhan Mantri Suraksha Bima Yojana.

Only 20% population of India is covered by any type of insurance and it is a very Good step by Government to cover the maximum numbers of people in this accidental insurance scheme. This scheme is most benficial for those who are living under the poverty line and unable to pay the large amount of premium for the insurance. This is a big step by PM Modi for making accident insurance affordable for everyone.

Salient Features of Pradhan Mantri Suraksha Bima Yojana

| Eligibity | Features |

|---|---|

| Age | 18 to 70 years |

| Bank Requirement | Saving Bank Account in Public Sector or Private Sector Bank |

| Insurance Premium | Rs.12.00 |

| Insured Amount | 2 lac for death and Permanent disability and 1 lac for partial disability |

| How to Pay Premium | Auto debit from the saving bank account |

| Period of Insurance | 1 Year (1st June to 31st May) |

| KYC | Aadhar Card |

Eligibility

- The age of policy holder should be between 18 to 70 years.

- He must have a bank account in any Indian Bank and have a valid Aadhar Card.

- He has an amount of Rs. 12 in his account and gives his consent to join PMBSY.

Pradhan Mantri Suraksha Bima Yojana Premium

The premium of Pradhan Mantri Suraksha Bima Yojana is just 12 Rupees per year which makes it affordable for all. Now even Poorest of poor can also avail the benefits of PMSBY scheme. This amount is auto debited from the saving account of policy holder in the month of June after applying for this accidental insurance plan. The government is planning to maintain the premium amount as Rs. 12 in upcoming years also. If amount could not be debited for any reason on 1st June the policy will go on hold for that period and will auto start as soon as premium will debit from the account. So it is advisable for the policy holders to maintain at least Rs. 12 in their account for hassle free policy. The period of Insurance is 1st June to 31st May.

PM Suraksha Bima Yojana Coverage

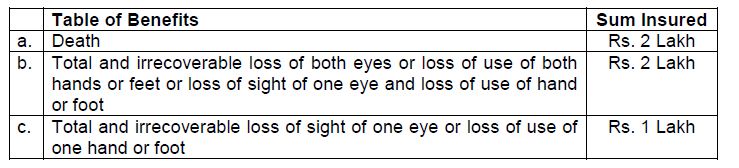

PMSBY covers death by accident and permanent disability by accident or by accidental injuries. The cover for death and permanent disability would be 2 lacs and for partial permanent disability, it would be 1 lac. If a person loses his both eyes, both hands, and both legs then he would get the full claim of two lac. If a person loses his one leg, one eye or one hand then he will come in partial permanent disability category and he would get the claim of 1 lac.

PM Suraksha Bima Yojana Benefits

The main benefit of Pradhan Mantri Suraksha Bima Yojana Coverage is the premium amount of just Rs. 12. Other major benefits are:

- Permanent disability and death benefits are up to 2,00,000 (2 Lac).

- Partial disability benefits are upto 1,00,000 (1 Lac).

- The policy holders will also get tax benefits under section 80C.

- This scheme is open for all citizens of India, whether He is a taxpayer citizen or people below poverty line.

How to Get Suraksha Bima Yojana

There are Two ways to avail the Suraksha Bima Yojana.

Online Mode: Account holders of the bank can take this policy by applying online. Most of the banks are offering this accidental insurance in just 12 rs via online mode. If you have Net Banking enabled in your account, you can easily purchase the insurance by paying the amount of 12 rs. You have to fill a simple form and provide few details like nominee date, relation with nominee and give your consent for auto debit facility. I have purchased my policy through ICICI online banking. Kindly, check the respective bank website for more details.

Offline Mode: You can purchase the policy by visiting the branch and ask for Suraksha Bima Yojana form. You have to provide few details in the form like nominee name, relation with nominee, his address, etc. Also you have to give you approval for the auto debit of premium.

Claim Process of PMSBY

In the unfortunate event of death nominee has to contact the branch of policy holder within the thirty days of accident.

- He has to fill the claim form along with FIR report, Death certificate and post mortem report.

- Now bank will send all the documents to the insurer company for the claim process

- After verifying the documents the insurance company will transfer the claim amount to the nominee account within 30 days.

- If claim is rejected due to some reasons the insurance company will intimate the bank and the bank will intimate the nominee.

In case of permanent disability and partial disability the policy holder has to submit the claim form along with disability certificate issued by civil surgeon. Other procedure will remain the same as above.

Download the Claim Form Here.

Termination of Insurance Policy

- If the insurer has completed 70 years of age.

- If saving bank account closed due to insufficient balance or any other reason and amount cannot be debited

- If policy holder has taken more than one policy from other bank account also.

- If the amount cannot be debited due to low balance, in this case policy will go on hold for that period and it will resume after the payment.

PMSBY Application Form and Claim form

PMSBY Application and Claim forms can be downloaded from Here in English and Hindi along with different Indian languages like Bangla, Gujarati, Kannada, Marathi, Odia, Tamil and Telugu.

Useful Information and Facts

For Pradhan Mantri Suraksha Bima Yojana frequently asked questions you can download FAQ pdf from this link http://www.jansuraksha.gov.in/Files/PMJJBY/ENGLISH/FAQ.pdf

As of 16 April 2016, 94,139,019 people got registered for this affordable accidental insurance.

For more information of PM Suraksha Bima Scheme you can log on to These Indian Government sites http://www.financialservices.gov.in and http://www.jansuraksha.gov.in. You can also call on these toll free numbers 1800 110 001 / 1800 180 1111. State wise toll free can be downloaded from this link.

How much maximum ins. Can i get